Report: Swedish life science is growing and exports are increasing strongly

Vinnova's latest statistics on Swedish life science companies

Report: Swedish life science is growing and exports are increasing strongly

Go directly to the reportVinnova's follow-up of the Swedish life science sector shows a continued clear growth of the industry, which is also increasing strongly in exports. Vinnova now presents the latest statistics on Sweden's life science companies - a government assignment that began in 2021.

"Life science is an important area of strength for Sweden, where the companies described in these statistics play a crucial role," says Darja Isaksson, director general of Vinnova. I hope that the statistics can form the basis for important discussions on how we can continue to strengthen and develop Swedish life science, so that Sweden can play an important role as an innovative force internationally, for example in the introduction of precision medicine.

The report was submitted to the government on October 16 and is the second annual survey from Vinnova on the development of Swedish life science companies. This year's report also includes an in-depth look at deeptech. On Wednesday, October 23, there is an opportunity to take part in a seminar where the latest statistics are presented. The registration link is further down the page.

I hope that the statistics can form the basis for important discussions about how we can continue to strengthen and develop Swedish life science, so that Sweden can play an important role as an innovative force internationally, for example in the introduction of precision medicine.

Strongly increased exports

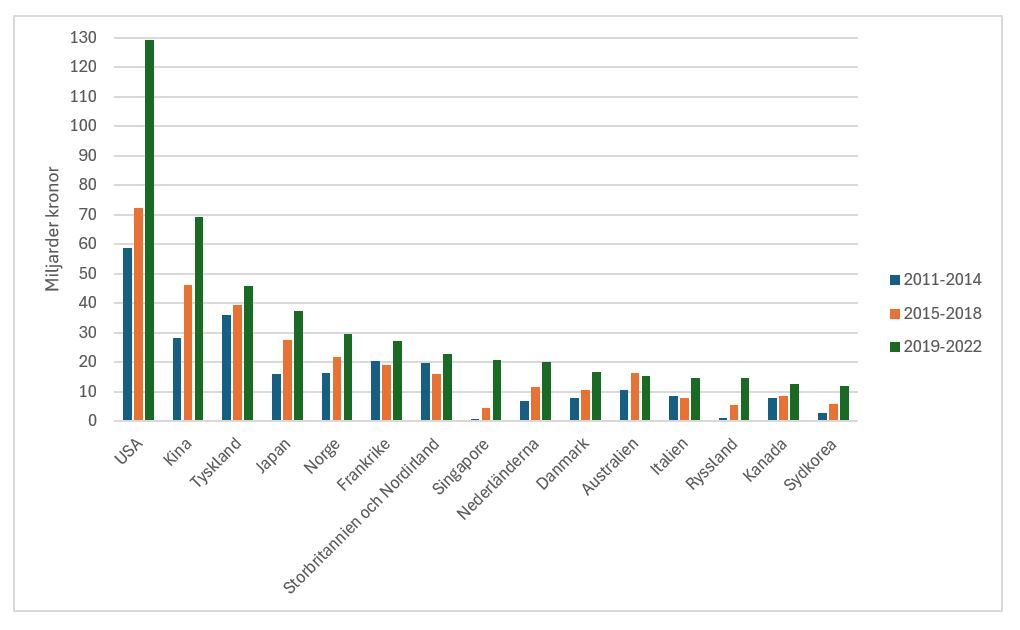

Exports increased to all 15 of the largest goods export countries for Swedish life science companies.

One of the fastest growing export markets for Swedish life science companies is Singapore. Exports to the country have increased by a whopping 2610 percent from the earliest reported interval of 2011–2014 to the interval of 2019–2022. Exports to Singapore went from SEK 0.8 billion to SEK 20.9 billion during each four-year period.

Caption: Swedish life science companies have multiplied their exports to countries such as Singapore over the past decade.

Swedish innovation office in Singapore

Singapore, where Swedish life science exports have increased at a record rate, is in fourth place in the UN's annual Global Innovation Index survey. Sweden is in second place in this innovation index, closely followed by the USA. Switzerland once again tops the innovation index this year.

It can be mentioned here that Vinnova has established an office in Singapore this year to facilitate innovation exchange between the countries. The office is staffed by an employee from Vinnova.

Industries that overlap

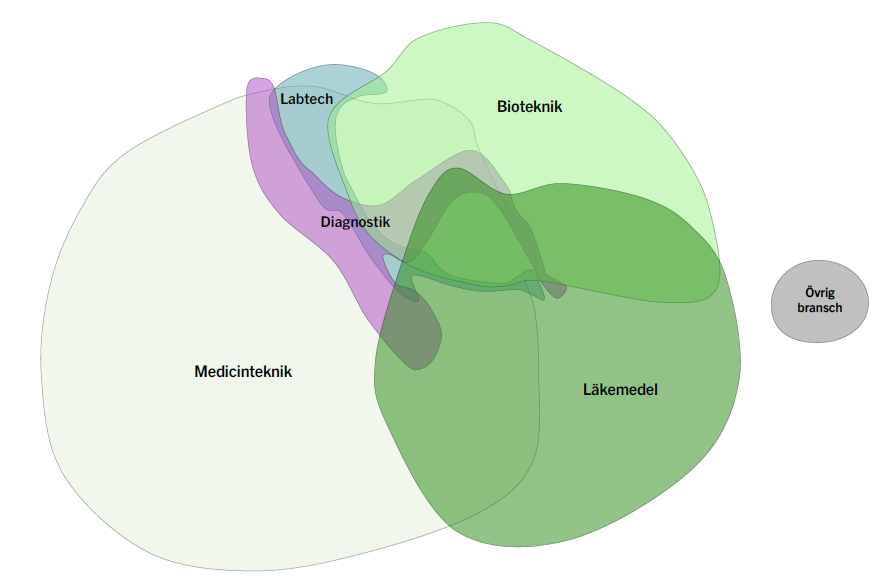

Medical technology is the largest sector within life science in terms of the number of companies, while laboratory technology and diagnostics are the sector's smallest surveyed sectors. Companies in the life science sector are often active in several different sectors. For example, in laboratory technology and diagnostics, we see a large overlap with medical technology.

- The overlap between the different sectors is natural. Technologies used in medicine – everything from assistive devices and implants to surgery, e-health solutions and diagnostics – all belong in the medical technology sector, explains Malin Hollmark, research and innovation expert at Swedish Medtech.

The chart above shows companies in the life sciences sector industries in 2022. There is overlap because companies are classified in multiple industries. This means that the number of companies in each industry cannot be summed to a total for the sector.

The purple area in the graph above shows the type of diagnostics where samples are taken and analyzed outside the body, such as blood or tissue samples. This is a small but growing sector. Other diagnostics, such as X-rays, CT and MRI, are also included in the medical technology sector.

What does deeptech mean in life science companies?

This year's report takes a deeper look at deeptech. The intention was to explore what deeptech looks like within the life science sector.

The report shows that there are a number of companies with a high degree of deeptech among Swedish life science companies.

However, there has often been a lack of sufficient information to make a reliable assessment of the number. The work of identifying the approximately 60 companies described in the in-depth report has largely been done manually. It proved to be a challenge to develop an automated method for identifying deeptech companies in life sciences.

The fact that it is difficult to categorize and identify deeptech companies in the life science sector, I think, only shows that we do not know today which future technologies will drive the next major breakthrough in clinical care.

We see that deeptech companies are present in all industry categories covered by the main report, i.e. biotechnology, diagnostics, medical technology, laboratory technology and pharmaceuticals. A large majority of deeptech companies have at least one founder with a PhD, and more than half have at least one founder who is a professor.

Companies often combine several different technologies to develop their deeptech innovations. These technologies include AI, synthetic biology, nanotechnology, and sensor technology, to name a few.

- Many groundbreaking innovations that have changed the lives of patients around the world have their roots in technologies developed outside healthcare – such as lasers, AI and nanotechnology – and which later found their applications in healthcare, says Malin Hollmark at Swedish Medtech.

- The fact that it is difficult to categorize and identify deeptech companies in the life science sector, I think, only shows that today we do not know which future technologies will drive the next major breakthrough in clinical care.

Many groundbreaking innovations that have changed the lives of patients around the world have their roots in technologies developed outside healthcare – such as lasers, AI and nanotechnology – and which later found their applications in healthcare.

Here you can find the in-depth report on deeptech in Swedish life science companies:

In-depth report on deeptech in Swedish life science companies 2024 - Appendix 1

Deeptech is a relatively new concept in research and innovation. Therefore, Vinnova has compiled a report that describes deeptech as a phenomenon and what can distinguish a deeptech company or be included in the concept of deeptech innovation. The report can be found here:

Are you ready for deeptech - a new wave of disruptive innovations

Seminar: How are Sweden's 4,000 life science companies doing?

On Wednesday, October 23, 2024, Sweden BIO and Vinnova held a webcast seminar with a presentation and discussion of Vinnova's latest report on the life science industry.

Watch the seminar afterwards

Attachments

Here we list the appendices in the 2024 survey of Swedish life science companies.

Appendix 1: In-depth report on deeptech in Swedish life science companies 2024

Appendix 3: Brief description of the method

for the life science business population

Appendix 4: Method description

Appendix 5: Change in Statistics Sweden's statistics

from 2022

Appendix 6: Company population in life science.pdf

Appendix 7: Newly started companies by county

Appendix 8: Number of employees per county

Appendix 9: Compilation of statistics

from the University Chancellor's Office

- Published

- 2024-October

- Series number

- Publisher

- Vinnova – Sveriges innovationsmyndighet

- Author

- Emelie Falk, Garance Legrand, Jennie Persson, Jessica Tägtström, Jonas Tranell

- ISBN

- 978-91-89905-13-9

- ISSN

- Number of pages

- 54